Insiders Believe this Tech Giant Is Undervalued

Nov 19, 2020 by InvestorDestination Team

COVD-19 has made zooming a verb and igniting investors' enthusiasm for technology stocks. However, the rising tide is not lifting Intel (NASDAQ: INTC)

Investors are concerned about Intel losing market share

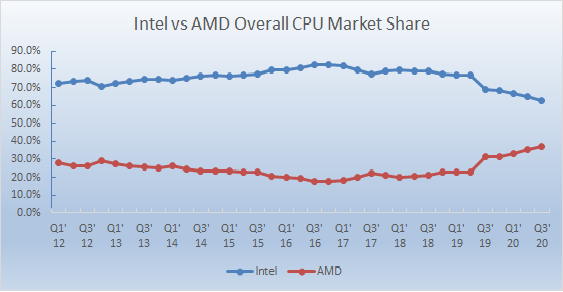

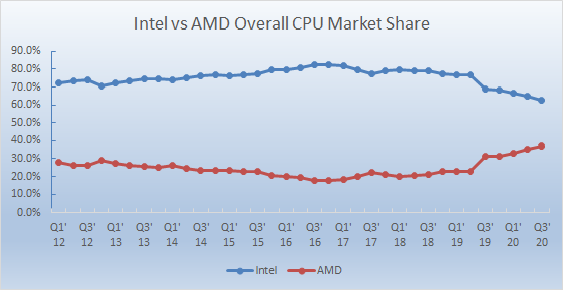

As the client computing business is on the decline, Intel has focused on diversifying and growing its data center business. Despite its diversification efforts, CPUs account for the majority of its revenue.. In recent years, the company is losing market share in the overall CPU market due to self-inflicted challenges and AMD’s stellar performance. Once struggling, AMD has turned around and strengthened its product portfolio. In the last four years, AMD has doubled its market share.

Source:Statista

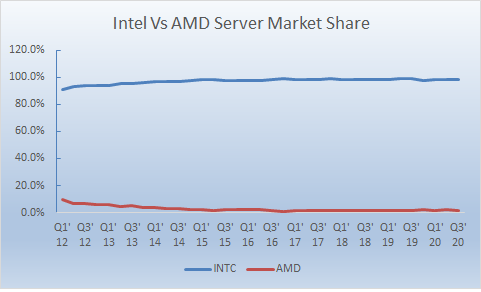

Investors are concerned about Intel losing market share. However, Intel is still the market leader. While AMD is rapidly gaining market share in the desktop PC market, Intel still holds more than 80% of the market share in laptop and more than 90% in server markets.

Source:Statista

Intel's 7nm process delay has further shaken investors' confidence in Intel's ability to execute.

Lowering margin guidance is further spooking investors

The remote economy has ignited the demand for client computing devices and increased data center investments. In the second half of this year, data center investment is entering a digestion phase and global economic challenges have forced the enterprise and government sector to curtail spending. Intel's margins declined during the recent quarter, and it has lowered its full-year margin guidance. The company has blamed that on lower revenue from the data center segment. However, investors are wondering whether it is the beginning of an end.

Conclusion

| Intel | AMD | NVDA | |

|---|---|---|---|

| Revenue (in millions) | 78,098 | 8,646 | 13,065 |

| EPS | 5.1 | 0.74 | 6.1 |

| Revenue Growth | 1.6% | 4% | (6.8%) |

| Operating Margin | 31.8% | 13.3% | 27.1% |

| FCF % Sale | 24% | 4% | 39% |

| TEV (in millions) | 222,866 | 99,609 | 321,941 |

| PE | 9.0 | 115.3 | 85.5 |

| PS | 2.5 | 11.7 | 24.5 |

Despite all its challenges, Intel is still generating a strong profit and cash flow. It has a strong balance sheet and pays dividends. The company is continuing its diversification. In recent years, it has expanded its product portfolio through acquisitions and is going after growing segments such as AI and 5G. According to comparison valuation, the company is undervalued. Its insiders share this sentiment too, and they are buying shares. When the company fixes its current execution challenges and starts generating higher revenue from growing segments such as AI, patient investors will be rewarded.